- International Travellers

- Tourists

- Hajj & Umrah Pilgrims

- FCY Account Holders

- International Students

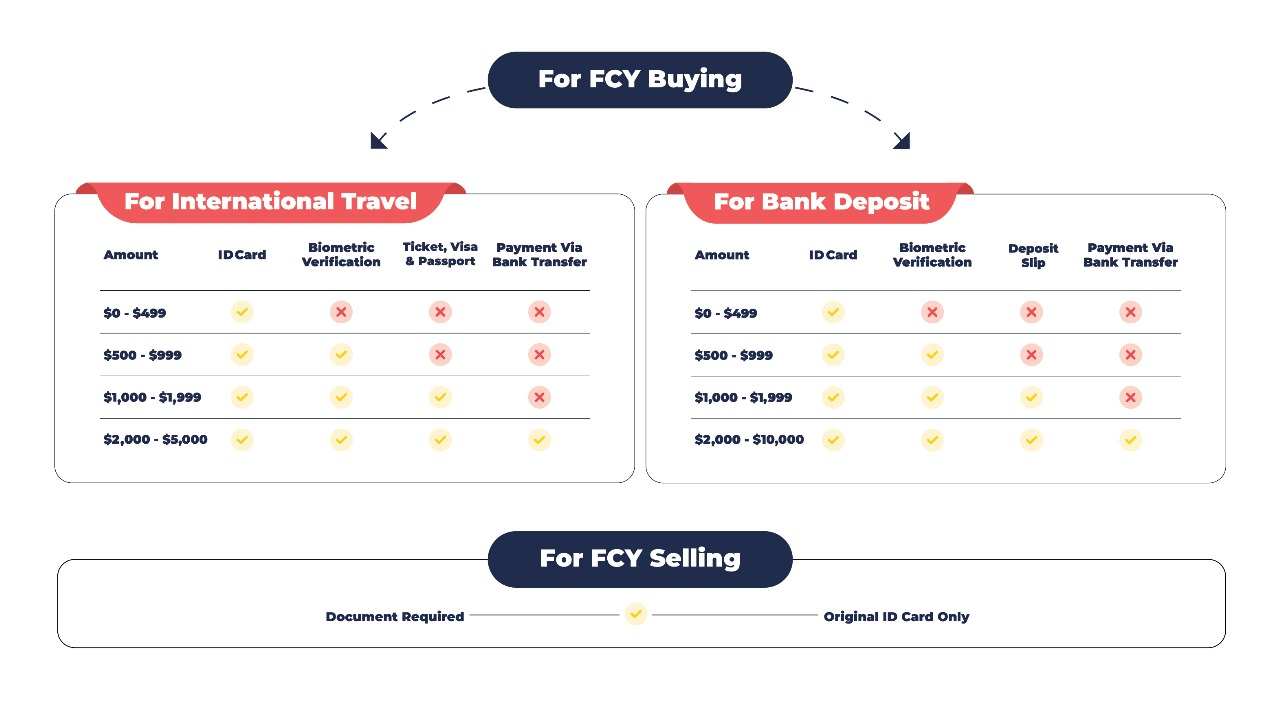

Currency Exchange

Buy or Sell 30+ foreign currencies at competitive market rates with ZeeQue Exchange.

Customers can purchase foreign currency for travelling abroad or for depositing foreign

currency in their commercial bank accounts.

Get To Know More

About Currency Exchange

Frequent Users

Terms & Conditions

- Customers can purchase up to $5000 for each international ticket.

- Customers must share the FCY bank deposit slip with ZeeQue Exchange.

- Customers can not purchase more than $10,000 in a single day.

- Customers can not purchase more than $100,000 in one calender year.

- Customers can not purchase more than $30,000 for the purpose of travelling in one calender year.

- All original documents shall be brought to the branch.

- Expired documents will not be accepted.

- ZQEC holds the right to change transaction requirements at any time in line with the procedures set by the State Bank of Pakistan.

International Money Transfers

(TT) / International Bank Account Transfers

We enable our customers to transfer funds abroad to 180+ countries to support their overseas family (blood relatives). Transfers reach the destination bank account within 2-3 business days.

Download How To Guide

Get to Know More About International Money Transfers

Permissible Use-Cases:

- Family Support (Blood Relative)

- International University Fee Payments

- International Hospital Bill Payments

Requirements

- Family Support – Senders Bank Statement, Sender ID Card, Senders Biometric Verification, Receivers Passport

- International University Fee Payments – University Offer Letter, Senders ID Card, Senders Biometric Verification, Student Passport

- International Hospital Bill Payments – Hospital Treatment Proposal, Senders CNIC, Patients Passport, Local Doctor Recommendation (incl. stamp)

Terms & Conditions

- For transfers under family support, the sender and receiver must have a blood relation.

- Customers can transfer up to $10,000 in a single day.

- Customers can transfer up to $100,000 in one calender year.

- All original documents shall be brought to the branch.

- Expired documents will not be accepted.

- ZQEC holds the right to change transaction requirements at any time in line with the procedures set by the State Bank of Pakistan.

International University Fee Transfers

ZeeQue Exchange Company Pvt. Ltd. strives to provide transparent, premium quality services to our clientele that add the most value in terms of convenience. We offer the following services.

Download How To GuideGet to Know More About International University Fee Transfers

Our Three Step Process

Download & Fill The Form

Visit Any ZeeQue Exchange Branch

Biometric Verification & Payment At Branch

Document Requirements

University Offer Letter (mentioning fee amount)

Senders ID Card

Students Passport

Terms & Conditions

- Customers can transfer up to $10,000 in a single day.

- ZQEC holds the right to change transaction requirements at any time in line with the procedures set by the State Bank of Pakistan.

Home Remittance

Receive your payments sent via Western Union, MoneyGram and RIA Money Transfer from any of our 45+ branches across Pakistan.

Get to Know More About Home Remittance

How To Guide:

- Visit Your Nearest ZeeQue Exchange Branch

- Provide Your Transaction Reference Number & Original ID Card

- Receive Your Home Remittance Payment

Requirements

- Transaction Reference Number

- Original ID Card

Terms & Conditions

- ZQEC holds the right to change transaction requirements at any time in line with the procedures set by the State Bank of Pakistan.

- Expired documents will not be accepted.

Branchless Banking

BILLS PAYMENTS

Our valued clients can now rely on ZeeQue Exchange for the timely payment of their electricity, water, gas, telephone and internet bills through our partnership with JazzCash. This service is available at all ZeeQue branches across Pakistan.

BANK DEPOSITS

ZeeQue Exchange now provides the value-added facility to deposit FCY cheques in FE-25 accounts of our valued clients to avoid cash note movement and inevitably reduce the risk that arises from carrying large amounts of cash.